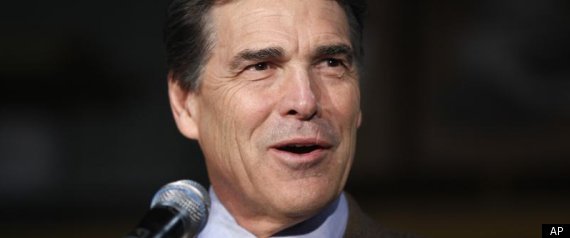

During his presidential campaign announcement speech last week, Texas Gov. Rick Perry lamented the "injustice" that nearly half of all Americans -- the poorest half -- "don't even pay any income tax." But in Texas, the tax burden is disproportionately shouldered by those families living below the poverty line, newly-released data from the Census Bureau show.

During his presidential campaign announcement speech last week, Texas Gov. Rick Perry lamented the "injustice" that nearly half of all Americans -- the poorest half -- "don't even pay any income tax." But in Texas, the tax burden is disproportionately shouldered by those families living below the poverty line, newly-released data from the Census Bureau show.While Texas is generally considered a low-tax state since it doesn't impose a personal income tax, a new analysis by the Institute on Taxation and Economic Policy finds the state's tax laws actually "redistribute income away from ordinary families and towards the richest Texans."

Taxes paid by the poorest 20 percent of Texas households -- those with incomes averaging $11,200 a year -- are actually the fifth highest in the nation, even though none of those households make enough money to owe federal income tax.

"With poverty rates on the rise, the Texas tax system is actually pushing families further into poverty," said Meg Wiehe, ITEP's State Tax Policy Director.

According to the Tax Policy Center, three-fourths of the 46 percent of U.S. households that pay no federal income tax earn $30,000 or less per year. But those families pay the same share of gasoline taxes, payroll taxes, excise taxes, property and sales taxes as the wealthy, so they end up paying the government a larger percentage of their incomes.

Texas, in particular, is "extremely imbalanced" in its reliance on sales and property taxes, the report concludes. Even without having to pay income tax, the poorest fifth of Texans ended up paying about 12 percent of their income in taxes in 2009, ITEP reports. The wealthiest 1 percent of Texans paid only 3 percent of their income in state and local taxes.

Still, Perry appears concerned that the rich are carrying too much of the nation's financial burden.

"Spreading the wealth punishes success," he said during his announcement speech on Saturday, "while setting America on a course to greater dependency on government."

The distribution of wealth in America at the end of 2009 was the most unequal it's ever been, with the wealthiest 1 percent of U.S. households having 225 times the net worth of the median household.

A Perry spokesperson did not immediately return requests for comment Friday.

Origin

Source: Huffington

No comments:

Post a Comment